Payroll tax deduction calculator 2023

Wage withholding is the prepayment of income tax. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Tax Compliance Calendar For Fy 2019 20 It Gst Tds Eztax In Compliance Small And Medium Businesses Income Tax Return

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

. As the employer you must also match your employees contributions. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Click here to see why you still need to file to get your Tax Refund.

Tax withheld for individuals calculator. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. There are 3 withholding calculators you can use depending on your situation.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. Free SARS Income Tax Calculator 2023 TaxTim SA. The maximum an employee will pay in 2022 is 911400.

2022-2023 Online Payroll Tax. The payroll tax rate reverted to 545 on 1 July 2022. For example based on the rates for 2022-2023 a.

The standard FUTA tax rate is 6 so your. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. To change your tax withholding amount.

Under FICA you also need to withhold 145 of each employees taxable. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company.

Start the TAXstimator Then select your IRS Tax Return Filing Status. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan. Ask your employer if they use an automated.

Sign up for a free Taxpert account and e-file your returns each year they are due. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate.

See where that hard-earned money goes - with UK income tax National Insurance student. Multiply taxable gross wages by the number of pay periods per. It will confirm the deductions you include on your.

Try out the take-home calculator choose the 202223 tax year and see how it affects. Nanny Tax Payroll Calculator Gtm Payroll Services. SARS eFiling Tax Practitioner Auto-assessment New to tax SARS Income Tax Calculator.

Prepare and e-File your. Get a head start on your next return. 2022 Federal income tax withholding calculation.

The Tax withheld for individuals calculator is. 2023 Paid Family Leave Payroll Deduction Calculator. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Begin tax planning using the 2023 Return Calculator below. Estimate your tax refund with HR Blocks free income tax calculator. It will be updated with 2023 tax year data as soon the data is available from the IRS.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross wages each pay period. Choose the right calculator.

UK PAYE Tax Calculator 2022 2023. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

In 2023 these deductions are. Bring steadiness to comprehensive tax planning and access the projected inflation-adjusted federal tax amounts for 2023 available within hours of release by.

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

Is Tax Loss Harvesting Worth It Tax Loss Worth

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

The Freelancer S Approach To Avoiding Gst Headaches In 2022 Goods And Service Tax Investing Goods And Services

Manage Your Distribution Wholesale Billing By Marg Pharma Software Pharmacy Software Pharmacy Fun Pharmacy

Vehicle Log Book Template Excel Free Download Vehicle Intended For Vehicle Fuel Log Template Book Template Vehicle Maintenance Log Templates

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Income Taxpe Income Tax Payment And Education

Page Not Found Isle Of Man Isle Quiet Beach

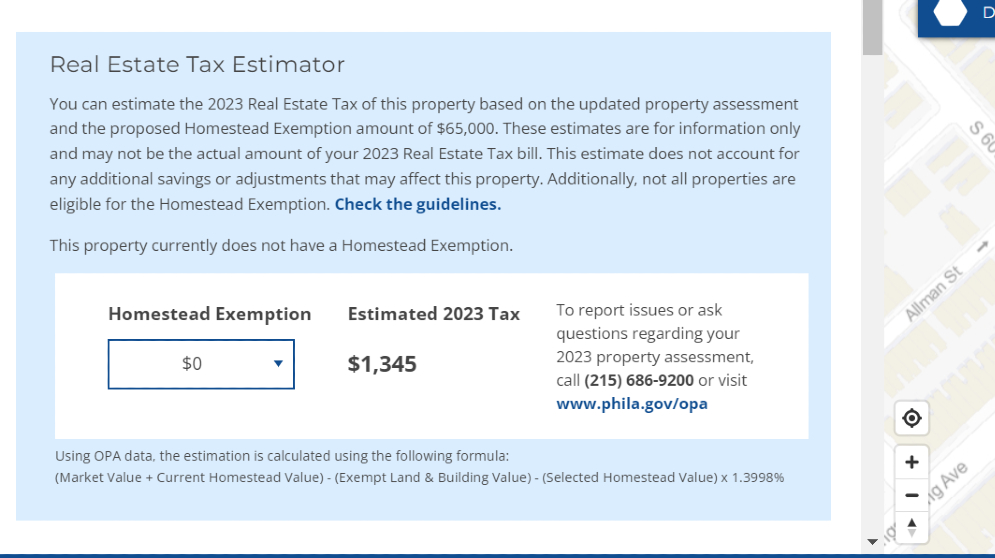

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Business Operating Budget Template Operating Budget Template Operating Budget Template What To Know About I Budget Template Free Budget Template Budgeting

Homebuyers Todolist To Become A Homeowner Home Buying Real Estate First Time Home Buyers

Growing Your Tsp Retirement Benefits Institute Retirement Calculator Retirement Planner Retirement Benefits

Pin On Budget Template

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023